Chapter 13 Bankruptcy Guidelines on FHA Mortgages

Chapter 13 Bankruptcy Guidelines on FHA Mortgages is almost identical, but VA loans are more lenient. Mortgage underwriters have a lot of discretion on manual underwriting files. Chapter 13 Bankruptcy Guidelines on FHA mortgages are very similar. FHA and VA loans are the only two mortgage loan programs that allow borrowers to qualify during the Chapter 13 Bankruptcy repayment plan.

The Bankruptcy does not need to be discharged. This article is about Chapter 13 Bankruptcy Guidelines on FHA Mortgages. However, we will mention Chapter 13 Bankruptcy Guidelines on VA loans because VA and FHA loans are the only mortgage options available during the repayment plan.

Not all lenders have the same lending requirements on Chapter 13 Bankruptcy guidelines on FHA mortgages. Even though HUD Chapter 13 Bankruptcy Guidelines on FHA mortgages allow borrowers to qualify while on Chapter 13 repayment plan, many lenders have overlays. Lender overlays are additional guidelines from lenders higher than the minimum HUD guidelines. In the following paragraphs, we will cover Chapter 13 Bankruptcy Guide.

Comparing Similarities From Chapter 13 Bankruptcy Guidelines on FHA Mortgages Versus VA Loans

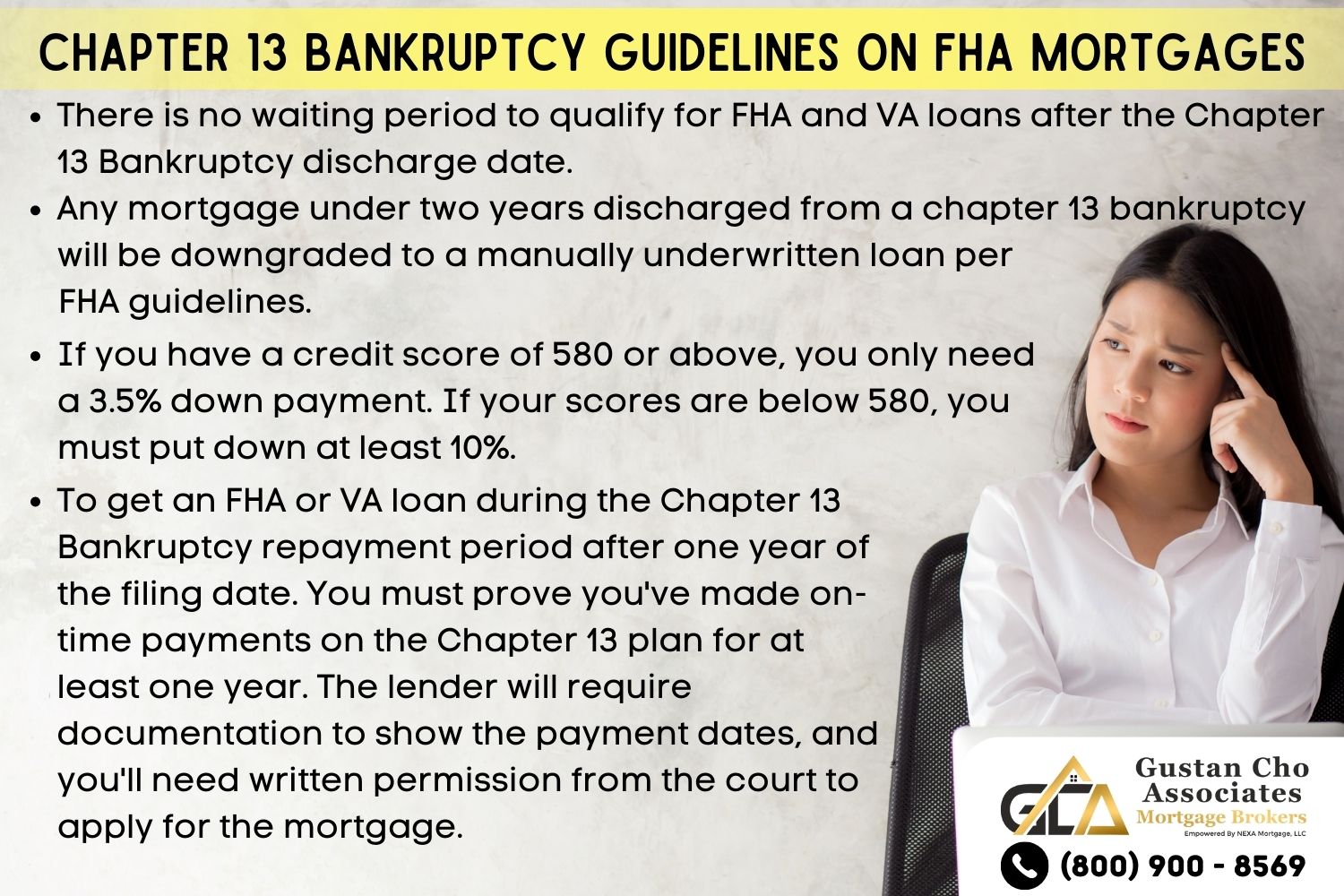

There is no waiting period to qualify for FHA and VA loans after the Chapter 13 Bankruptcy discharge date. Gustan Cho Associates team is experts in closing your FHA or VA loan during or after a Chapter 13 bankruptcy. Most Americans are unaware of the FHA and VA Chapter 13 Bankruptcy Guidelines on FHA mortgages. FHA loans require a 3.5% down payment where VA loans does not require a down payment, explains Ronda Butts, a dually licensed realtor and loan officer at Gustan Cho Associates:

Down Payment Guidelines: If you have a credit score of 580 or above, you only need a 3.5% down payment. If your scores are below 580, you must put down at least 10%. Typically, in an active Chapter 13 bankruptcy, your credit scores will hover around 580 – 600. Please read this blog on ways to INCREASE YOUR CREDIT SCORE to increase your chances of approval.

In my experience, even some bankruptcy attorneys are not up to date with the FHA and VA guidelines and sometimes give their clients the wrong advice. This article will discuss and cover Chapter 13 mortgage guidelines on FHA and VA loans. We will cover the updates on FHA and VA loans during and after Chapter 13 Bankruptcy agency guidelines. We will cover how to apply for FHA and VA loans during and after Chapter 13 Bankruptcy with Gustan Cho Associates.

Chapter 13 Bankruptcy Guidelines on FHA Mortgages During And After Repayment Period

Most lenders will tell you obtaining an FHA and VA mortgage during a Chapter 13 Bankruptcy is impossible. This is because they do not participate in manually underwriting mortgages or have LENDER OVERLAYS that get in the way. Manual underwriting overlays are some of the most common in the mortgage industry. Most banks will only close mortgage loans that have approved eligible automated underwriting system findings (AUS). For more information on automated underwriting systems, please read our AUS BLOG.

Overlays on Chapter 13 Bankruptcy Guidelines on FHA Mortgages

Since we do not have lender overlays and allow manual underwriting, we have become the experts on Chapter 13 Bankruptcy Guidelines on FHA Mortgages. As mentioned earlier and illustrated how similar, if not the same, how FHA and VA loans have similar guidelines during Chapter 13 Bankruptcy repayment plans with manual underwriting. Therefore, the Gustan Cho Associates team works on FHA and VA loans daily and knows the ins and outs of Chapter 13 Bankruptcy Guidelines on FHA Mortgages and VA Loans.

Mortgage Lenders That Work With Chapter 13

As you can tell from our website, we write blogs about this topic quite often. Below are the steps to obtain a mortgage in a Chapter 13 bankruptcy or under two years discharged from a Chapter 13 bankruptcy. (any mortgage under two years discharged from a Chapter 13 bankruptcy will be downgraded to a manually underwritten loan per FHA guidelines). Over 80% of the clients at Gustan Cho Associates could not qualify at other lenders. Many couldn’t qualify for an FHA loan while in Chapter 13 because lenders had overlays, says Alex Carlucci, a senior loan officer on Chapter 13 Bankruptcy guidelines on FHA mortgages.

HUD guidelines can be confusing. The HUD 4000.1 FHA Handbook details FHA mortgage guidelines and is over 1000 pages long. Don’t expect the average borrower to understand these mortgage guidelines. That is our job. In this handbook, Chapter 13 bankruptcy guidelines on FHA mortgages, our mission is to take the main points and make them easy to read and understand.

Again, FHA and VA loans have the same Chapter 13 Bankruptcy guidelines during and after the discharge date. The main items that need to be addressed are manual underwriting requirements and trustee permission to enter a new mortgage. Anytime a Chapter 13 Bankruptcy without a two-year seasoning after the discharge date is detected on your credit report, your file will be downgraded to a manual underwrite.

Chapter 13 Bankruptcy Guidelines on FHA Versus VA Loans

VA loans do not have maximum debt-to-income ratio caps on automated underwriting system approvals. However, on manual underwrites, there is a restriction on the maximum debt-to-income ratio requirements. FHA and VA manual underwriting on debt-to-income ratios is the same. Below are the FHA and VA manual underwriting guidelines on the debt-to-income ratio. However, mortgage underwriters can go beyond the manual underwriting guidelines below if borrowers have strong compensating factors and strong residual income:

- Credit scores below 580 (including no credit score) are limited to DTI ratios of 31/43

- Credit scores 580 and above are limited to 31/43 without compensating factors.

- Credit scores 580 and above are limited to 37/47 with one compensating factor.

- Credit scores 580 and above are limited to 40/40 with no other debt

- Credit scores 580 and above are limited to 40/50 with two compensating factors

The above debt-to-income ratio guidelines are a bench mark for mortgage underwriters to go by. Underwriters have a lot of underwriting discretion on manual underwrites. Debt-to-income is a key aspect of qualifying for any mortgage. The debt-to-income requirements are more strict when manual underwriting is involved. Your debt-to-income requirements will change depending on your credit score and compensating factors:

Chapter 13 Bankruptcy Guidelines on Trustee Approval

Getting bankruptcy trustee approval is the same process for FHA and VA loans. This process scares many potential borrowers in active Chapter 13 bankruptcy. While in your repayment plan, you must be granted permission from your trustee to enter into a mortgage. Your bankruptcy attorney can help you with this process.

You must send the trustee a preapproval letter and an estimation of lending fees. They will review the documentation and approve or deny your request to buy a home. If your mortgage payment is close to what you’re paying in rent, they will sign off on you entering a mortgage.

They may ask for more information if your mortgage payment is significantly higher than your current rental payment. They may want your current finances to ensure you can afford the payment. Sometimes they will even increase your Chapter 13 payment due to higher income. Before contacting the trustee, you want to discuss this with your real estate attorney.

Changes To HUD Chapter 13 Bankruptcy Guidelines on FHA Mortgages

The key change for 2023: FHA loan amounts and maximum loan limits. The good news is in the calendar year 2023. You can now borrow even more money to buy a more expensive home while in a Chapter 13 bankruptcy. Depending on your debt-to-income qualifications, the maximum loan amount in most counties nationwide is $472,030. This number is adjusted annually based on home price index information collected nationwide. The increase in the loan amount is designed to help Americans buy affordable housing with FHA-backed mortgages. The Federal Housing Finance Agency (FHFA) will publish home price index data annually.

FHA Loans During Chapter 13 Bankruptcy Repayment

Now that you understand the basics of buying or refinancing a home while currently in a Chapter 13 Bankruptcy or if your Chapter 13 discharge has been seasoned for less than two years, contact us at Gustan Cho Associates. The team at Gustan Cho Associates are the experts in bankruptcy mortgage financing. We encourage you to check out our reviews and our YouTube CHANNEL. Our team continues to stay up to date on all guideline changes! For any mortgage questions, please get in touch with us at gcho@gustancho.com.

Chapter 13 Bankruptcy Guidelines on FHA Mortgages Trustee Approval Process

HUD Chapter 13 Bankruptcy Guidelines on FHA mortgages state that the FHA Loan Requirements for borrowers in progress in a repayment Plan can qualify for FHA loans. HUD Chapter 13 Bankruptcy Guidelines on FHA mortgages state that borrowers who have just had their Chapter 13 Bankruptcy discharge have no waiting period requirements. HUD, the United States Department of Housing and Urban Development, is the Federal Housing Administration’s or FHA’s parent. FHA is not a mortgage lender. FHA is a division of the HUD

What Is The Role of HUD on FHA Loans?

The role and purpose of the U.S. Housing and Urban Development through the Federal Housing Administration is to insure private lenders who follow FHA guidelines if banks and mortgage lenders who are FHA-approved lenders follow FHA Guidelines.

HUD will insure those banks and lenders if borrowers default on their FHA loans and go into foreclosure. The following paragraphs will discuss HUD Chapter 13 Mortgage Guidelines on FHA Mortgages during and after the Chapter 13 Repayment Plan.

HUD is the parent of FHA. FHA is not a mortgage lender. FHA is a government agency under the United States Department of Housing and Urban Development and sets the HUD Guidelines After Bankruptcy. Borrowers can qualify for FHA loans after bankruptcy. Even if your Chapter 13 bankruptcy is discharged, you will require a manual underwrite until your discharge lasts two years. Manual underwriting requirements surrounding Chapter 13 bankruptcy: Some basic manual underwriting requirements must be met to qualify for an FHA mortgage during a Chapter 13 bankruptcy. We will dive into those now.

Can I Buy a House After Filing For Bankruptcy

The most popular consumer bankruptcies are Chapter 7 and Chapter 13 Bankruptcy. Chapter 7 Bankruptcy is very simple, and consumers can file Chapter 7 and get the bankruptcy discharged in 90 days. There is a two-year waiting period to qualify for an FHA and VA loan two years after Chapter 7 Bankruptcy. Chapter 13 Bankruptcy is a debt restructuring program. Most Chapter 13 Bankruptcies are a three to five-year repayment plan. The bankruptcy trustee will take a percentage of your gross monthly pay and allocate those funds to repay your creditors. Once the repayment term is up, the balance of your debts gets discharged.

Chapter 7 Bankruptcy is also called total liquidation. There are requirements for qualifying for Chapter 7 Bankruptcy. Consumers have the maximum amount they can make to qualify for a Chapter 7 Bankruptcy. All of their assets need to be disclosed. Chapter 7 Bankruptcy is best suited for consumers who are unemployed and have little to no assets and are drowning in debt. Once you file a Chapter 7 Bankruptcy, the Bankruptcy Trustee will review all the assets and debts.

All of the consumer’s debts are normally discharged in 90 days. A Chapter 7 Bankruptcy discharge will wipe out all of the consumer’s debts, and the consumer will be debt free after the Chapter 7 Bankruptcy discharge. Borrowers can qualify for an FHA loan two years after a Chapter 7 Bankruptcy discharge date. Needs re-established credit and no late payment history after the Chapter 7 Bankruptcy discharge date.

How Does Chapter 13 Bankruptcy Work?

Chapter 13 Bankruptcy is when the Bankruptcy Court appoints a Chapter 13 Bankruptcy Trustee. The Trustee will review the petitioner’s gross income, take a percentage of their income, and use that portion to pay the consumer’s creditors.

A repayment plan of normally 60 months is set up by the Chapter 13 Bankruptcy Trustee. After that repayment period is over, the remaining debts will be discharged by the Bankruptcy Courts.

Borrowers can qualify for an FHA loan while in the repayment period of Chapter 13 Bankruptcy. Borrowers can also qualify for FHA loans after the discharge date of the Chapter 13 Bankruptcy, which we will cover in the following paragraphs.

Chapter 13 Bankruptcy Guidelines on FHA Mortgages on Manual Underwriting

There are two ways of qualifying for an FHA Loan for borrowers in Chapter 13 Bankruptcy. Borrowers currently in a Chapter 13 Bankruptcy Repayment Plan can qualify for an FHA Loan one year into a Chapter 13 Bankruptcy; Borrowers who have had their Chapter 13 Bankruptcy Discharged can qualify for an FHA Loan on the day after their Chapter 13 Bankruptcy discharged date.

Why Every Lender Has Different FHA Loan Requirements

Unfortunately, most mortgage lenders have a mandatory waiting period Chapter 13 Bankruptcy discharge date of one to two-year waiting period after the discharge date. This holds although HUD Chapter 13 Bankruptcy Guidelines state that no waiting period is required.

HUD Chapter 13 Bankruptcy Guidelines on FHA mortgages require borrowers currently on a Chapter 13 Bankruptcy repayment period to qualify for an FHA loan one year into the Chapter 13 Bankruptcy repayment period.

FHA loan needs to be manually underwritten. Verification of Rent is required with manual underwriting. HUD guidelines require the borrower to have 12 months of timely payments to all creditors that must be provided to the lender. Chapter 13 Bankruptcy guidelines on FHA mortgages require bankruptcy trustee Approval. Compensating Factors is required for borrowers with higher debt-to-income ratios. You cannot have late payments in the past 12 months.

HUD Chapter 13 Bankruptcy Guidelines on FHA Mortgage After Bankruptcy Discharge

HUD Bankruptcy Guidelines After Chapter 13 Bankruptcy Discharged Date states that no mandatory waiting period is required: Here are the guidelines. No waiting period is required to qualify for an FHA Loan after a Chapter 13 Bankruptcy discharge date.

All borrowers who had a Chapter 13 Bankruptcy discharge and have not met a two-year waiting period after the Chapter 13 Bankruptcy discharge date will qualify for an FHA loan. However, it needs to be manually underwritten. All manual underwriting requires VOR, which is the verification of rent.

Most lenders have issues approving FHA loans right after a Chapter 13 Bankruptcy discharge date. Most mortgage lenders will have lender overlays after the Chapter 13 Bankruptcy discharge date by requiring the following. There is NO WAITING PERIOD to qualify for an FHA loan after the Chapter 13 Bankruptcy discharge date. However, if the borrower had a Chapter 13 Bankruptcy discharge that has not been seasoned for at least two years, then the mortgage loan needs to be manual underwriting.

How To Get Approved For a Mortgage While in Chapter 13 Bankruptcy

Most lenders will set a mandatory waiting period after the Chapter 13 Bankruptcy discharge date of at least a one-year waiting period. Or a two-year waiting period after the Chapter 13 Bankruptcy discharge date. This is not a HUD Chapter 13 Bankruptcy Guideline but a mortgage lender overlay on behalf of the individual lender. If you are in a Chapter 13 Bankruptcy Repayment Plan or have just been discharged from your Chapter 13 Bankruptcy and need further information on qualifying for an FHA Loan, please get in touch with Gustan Cho at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com.